Are you living from paycheck to paycheck?

If yes, then a sound financial management plan is your light at the end of the tunnel. Having a plan will determine how you spend your income and allocate funds for expenses and savings.

You do not have to be a math geek. You simply have to know the basic addition and subtraction plus the difference between your net and gross.

Equally, you will need to possess two essential skills: discipline and commitment.

But first things first.

Let’s see how best you can differentiate between your income and expenses.

Identifying Income and Expenses

Income is the money you earn weekly, bi-weekly, or monthly. It can be in the form of salary, profits, bonuses, commission, or overtime wages.

You knew that already, didn’t you?

Expense is the cost you incur whenever you purchase or spend on planned and unplanned items. To quickly identify your costs, you can classify them into three:

- Fixed expenses: These are mandatory costs that recur each month, such as electricity bills, water bills, rent or mortgage, and subscription services such as Wi-Fi and membership fees.

- Variable expenses: They fluctuate from month to month, e.g. clothes and transportation costs.

- Wants: These are items on your wish list could be an expensive shoe or a weekend getaway.

Managing Your Income and Expenses

Read on to find ways that you can manage your income and expenses.

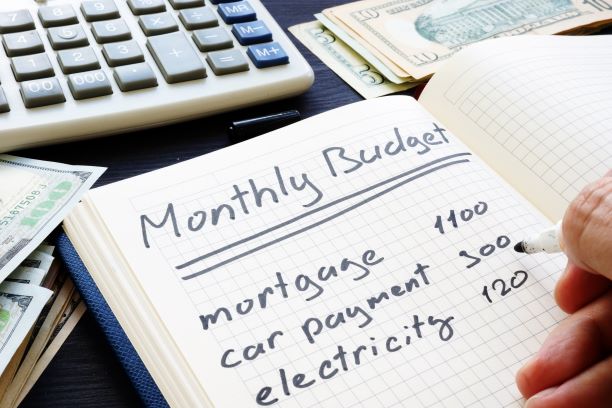

Create a Budget

What is a budget?

It is the lifeline to your finances and the first step to financial management. Rather than leaving your income to chance, you should challenge yourself to account for each coin you spend.

Yes, I know! It’s a tedious process and sometimes even boring.

But you don’t have to do it alone. You can utilize money management apps, such as:

- Mint

- Money lover

- Wally+

- Goodbudget

- Budgetsimple

The good thing with these apps is that they are free and available on Google play store. With features that can record, track, and prioritize your expenses, these apps can help you achieve your financial goals.

Besides, apps like the Budgetsimple will even give you suggestions on where to save on costs.

The 50/20/30 Rule

Alternatively, for the less tech-savvy person, you can use the 50/20/30 budget rule.

In her book, All Your Worth: The Ultimate Lifetime Moneyplan, Senator Elizabeth Warren emphasizes on efficient spending using the 50/20/30 rule.

Assuming that your income is 100%, the rule subdivides your budget into three costs:

- 50%- Fixed costs or needs: these are mandatory expenses, the must-haves for your survival. Recurring monthly bills like utility bills, mortgage, rent, car payments etc.

- 20%- Financial goals or savings: these are costs that are incurred when planning for your future, including emergency fund and purchasing stocks and bonds.

- 30%- Flexible spending or wants: the remainder of your income should be allocated to daily expenses, which vary in frequency and amount. Eating out, fuelling, and upgrading decisions such as selecting a premium subscription are good examples of flexible costs.

Expense ledger

An expenses ledger is a journal where you can record every purchase and cost, including bank charges.

Consider this your accountability partner especially when you cannot justify your expenses. For your receipts, you can have a small folder or an envelope where you can store them or a shoebox!.

In this way, you can easily track each cent.

Best Prices

Before making any purchase, you should shop around for alternative products or services.

This can even apply to products such as insurance and banks. In this case, you can assess costs and benefits and select a service provider who meets your needs.

For household items, electronics, and gadgets, you can get discounts, coupons, or the same things at a cheaper cost if you’re lucky. Remember, such expenses are one-off costs.

Therefore, they should go to your short-term goals if they are not pricey.

Still, because you want value for your money, do not double down too much on services such as healthcare.

Sudden Increase in cash flow

Do you have a huge salary, or you recently got promoted? Is it time to make a long-term commitment like applying for a loan for a fixed asset?

Well, it is essential to assess your ability to repay a loan without neglecting other responsibilities comfortably.

Try to make well-informed choices here. Best to engage the services of an investment banker or consultant.

While you may qualify for a loan, the bank is unaware of your other obligations.

So, you will still need to make a monthly repayment. Certain situations warrant taking a loan, including but not limited to:

- Boosting your business

- Clearing pending debts

- Sort an existing medical emergency

- Clearing student loans.

The rule is to determine whether your income is financing a need or want.

Think Long-term

The future is full of uncertainties despite planning, but you do not have to go in blind.

You can save a small amount of money monthly, preferably towards your retirement scheme. If you do not have a concrete plan for the future, you can still use a savings account.

This way, your money will earn interest as you try to figure out what you would like to use the money for.

Regardless of how much you earn, you can make hay with these tips.

If you spend money to buy what you don’t want, you might have to sell what you need to get the money you don’t have.

Remember, discipline and commitment are your companions. Simply follow through with your plan.

Let your money work for you by managing it appropriately.